2025/46 Draft Secondary Legislation on Pillar 2

It's a fundamental and complex tax model affecting approximately 8,000 companies worldwide. It's a minimum tax regime, unlike the "domestic minimum corporate tax" introduced by the same law in our country. We will summarize the new draft of secondary corporate tax legislation announced.

Turkish Tax Authorities Released Draft Secondary Legislation on Pillar 2

The "Local and Global Minimum Top-Up Corporate Income Tax" (MTUT) regulation, which entered into force in Turkey on August 2, 2024, and was added to Corporate Income Tax Law No. 5520, represents a significant turning point in the global taxation architecture. These regulations, in line with the Model Rules and Commentary established by the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting, aim to prevent multinational enterprise groups (MNE Groups) from transferring profits to countries with low tax rates and from having their annual earnings taxed below the minimum corporate tax rate of 15%. You can find the details about the new law by clicking the link.

This legislation covers MNE Groups whose annual consolidated revenues are equal to or greater than the Turkish Lira equivalent of 750 million Euros in at least two of the four accounting periods preceding the relevant accounting period. The determination of this revenue threshold is based on the revenue amounts reported in the income/loss statement of the group’s consolidated financial statements.

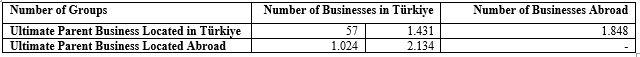

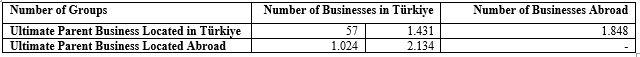

Impact Analysis: It is proposed to be implemented (with a separate declaration to be submitted in 2025) for 2024 revenues. An estimated revenue impact of 40 billion TL is expected. The table shows the number of businesses located in Turkey and those whose ultimate parent business is not in Turkey.

A total of roughly 8,000 companies worldwide is covered by this regulation. More than half of this number are large US and European companies. It can be safely said that a quarter of these companies are from Asia Pacific countries.

The MTUT regime fundamentally operates through two main mechanisms:

- Local Minimum Top-Up Corporate Income Tax (Local MTUT): Aims to bring the tax burden of constituent entities resident in Turkey up to the minimum rate.

- Global Minimum Top-Up Corporate Income Tax (Global MTUT): Regulates the collection of the top-up tax for low-taxed constituent entities, raising them to the minimum rate, through the Income Inclusion Rule (IIR) and the Undertaxed Profits Rule (UTPR).

The comprehensive communiqué published clarifies the technical details of the new tax liabilities, including the declaration and payment processes for taxpayers. Critical administrative obligations have been introduced, such as the requirement that the Local MTUT declaration must be filed and paid from the first day to the last day of the twelfth month following the month in which the accounting period closes, and the Global MTUT declaration must be filed within the relevant periods (including the transitional period for those filing for the first time).

To adapt to this new tax environment, MNE Groups need to correctly analyse not only their tax burdens but also the effects of complex Constituent Entity Based Income (CEBI) adjustments, deferred tax calculations, and international exception mechanisms (such as the Substance-Based Income Exclusion (SBIE) and the De Minimis application).

Our bulletin addresses the most critical and important issues contained in the draft "General Implementation Communiqué on Local and Global Minimum Top-Up Corporate Tax".

1. Basic Calculation Mechanisms under Local MTUT and Global MTUT

The tax liabilities of MNE Groups are determined primarily by identifying the Constituent Entity Based Income or Loss and the Adjusted Covered Taxes of each constituent entity.

1.1. Determination of Constituent Entity Based Income/Loss (Adjustments to Financial Accounting Net Income/Loss)

The main adjustments and deductions required to be made to the constituent entity's financial accounting net income or loss (FANIL) for the purpose of determining the CEBI are as follows:

- Covered Tax Expenses: All current period and deferred covered taxes accrued as expenses in the financial accounts, as well as taxes such as qualified local and global MTUT, and non-qualified refundable imputation tax, are added to FANIL.

- Excluded Dividends: The net amount of dividends received or accrued relating to ownership interests, excluding dividends relating to portfolio shares, is deducted from FANIL.

- Equity Gains or Losses: Gains or losses arising from changes in the fair value of ownership interests, excluding portfolio shareholding, or accounted for using the equity method are disregarded in determining the CEBI.

- Revaluation Method: Revaluation gains or losses of tangible fixed assets reported in Other Comprehensive Income (OCI) because of revaluation are added to FANIL.

- Business Restructurings: Gains or losses arising from the transfer of assets and liabilities under transactions such as mergers, acquisitions, and spin-offs are disregarded in determining the CEBI of the transferring constituent entity.

- Asymmetric Foreign Exchange Gains or Losses: Specific adjustments are made for foreign exchange gains or losses arising from the difference between the currency used by the constituent entity in its accounting calculations and the currency used in its tax calculations. For example, foreign exchange losses included in the accounting records are added to FANIL, while taxable foreign exchange gains are also added to FANIL.

- Penalties and Illegal Payments: Fines exceeding the Turkish Lira equivalent of 50,000 Euros and illegal payments are disregarded as expenses in the calculation of CEBI.

- Qualified Refundable/Marketable Tax Credits: These credits are treated as income in the calculation of CEBI.

1.2. Limitations Regarding Adjusted Covered Taxes

In calculating Adjusted Covered Taxes, only taxes accrued regarding CEBI are considered, and they are limited to taxes expected to be paid within three years.

- Three-Year Payment Rule: Current period tax expenses that are not expected to be paid within three years from the last day of the accounting period are deducted from covered taxes. Payments made after the expiry of the three-year period are not included in adjusted covered taxes.

- Uncertain Tax Positions: Current period tax expense related to an uncertain tax position is deducted from covered taxes until it is actually paid.

- Tax Credits: Tax credits that are not qualified refundable tax credits or marketable/transferable tax credits are deducted from the current period tax expense.

2. International Exceptions and Exemptions

2.1. Obligations of Exempt Entities

The application of IIR and UTPR does not apply to exempt entities (such as government entities, pension investment funds, non-profit organizations, etc.).

- The revenue of exempt entities is considered in determining the 750 million Euro revenue threshold.

- However, the profits, losses, accrued taxes, and assets of exempt entities are not included in other calculations under the MTUT regime.

- Exempt entities do not have any administrative obligations, including the requirement to complete the Global MTUT Information Return.

2.2. International Shipping Income Exclusion

Income derived from international shipping activities is exempt from MTUT. This exemption has complex limitations:

- Ancillary Activity Limit: Income derived from ancillary activities is exempt, provided that it does not exceed 50% of the total income derived from international shipping. In case of excess, the exceeding portion is included in the calculation of the jurisdiction-based income.

- Management Criterion: To qualify for the exemption, it must be proven that the strategic or commercial management of all relevant ships is effectively carried out in the country where the constituent entity is located.

- Non-Deductible Expenses: Expenses or losses related to exempted income cannot be deducted from non-exempt income.

3. Allocation of Global MTUT Liability (IIR and UTPR)

3.1. Tax Liability under the Income Inclusion Rule (IIR)

The IIR is applied through the ultimate parent entity (UPE), intermediate parent entity, or partially owned parent entity located in Turkey.

- Attributable Share: Parent entities subject to tax under IIR are responsible for the payment of the Global MTUT related to a low-taxed constituent entity, up to the proportion of their "Attributable Share".

- Attributable Share Calculation: Calculated by multiplying the amount of Global MTUT by the Parent Entity's Inclusion Ratio in the relevant constituent entity.

- Inclusion Ratio: The ratio obtained by dividing the amount found by subtracting the portion of a constituent entity's CEBI attributable to third parties from the CEBI, by the CEBI.

3.2. Tax Liability under the Undertaxed Profits Rule (UTPR)

UTPR collects the portion of the low-taxed income that cannot be collected under the IIR.

- Allocation Mechanism: The total Global MTUT amount determined under UTPR is allocated among UTPR jurisdictions based on the UTPR Percentage.

- UTPR Percentage: This is the sum of 50% of the ratio obtained by dividing the total number of employees in constituent entities located in Turkey by the total number of employees in all qualified UTPR jurisdictions, and 50% of the ratio obtained by dividing the total net book value of tangible assets in Turkey by the total net book value of tangible assets in all qualified UTPR jurisdictions.

- Zero Percentage Rule: Global MTUT allocation is also made to low-tax jurisdictions applying qualified UTPR, provided that the calculated UTPR percentage is not zero.

4. Substance-Based Income Exclusion (SBIE)

SBIE is deducted from the net jurisdiction-based income and is equal to the sum of the Gross Payroll Carve-Out Amount and the Tangible Asset Carve-Out Amount.

4.1. Carve-Out Rates (Transitional Period)

- In the 2025 accounting period: 7.8% of the net book value of tangible assets and 9.8% of the gross payroll of employees are considered.

- These rates are gradually reduced until the 2029 accounting period.

4.2. Gross Payroll Carve-Out Amount

- Scope: Only payments providing direct benefits, such as salaries, wages, compensation, and share options of employees within the scope of SBIE (including part-time and independent contractor employees), are considered.

- Restriction: Gross payroll expenses of employees attributable to income derived from international shipping activities are not included in this calculation.

4.3. Tangible Asset Carve-Out Amount

- Scope: The net book values of tangible fixed assets, natural resources, lessee’s right-of-use assets, and licenses obtained for the use of real estate located in the relevant jurisdiction are considered.

- Restriction: The net book values of real estate held for sale, lease, or investment purposes, and the net book values of tangible fixed assets related to international shipping activities are disregarded.

- Net Book Value: Calculated by taking the average of the net book values at the beginning and end of the accounting period.

5.Special Tax Liability Situations

5.1. De Minimis Application

If the constituent entities of an MNE Group in a jurisdiction have an average annual jurisdiction-based revenue of less than the Turkish Lira equivalent of 10 million Euros and an average annual jurisdiction-based income of less than the Turkish Lira equivalent of 1 million Euros, the Global MTUT liability in that jurisdiction is considered zero.

- Calculation Period: The average of the current accounting period and the two preceding accounting periods is considered when determining the average revenue and income/loss.

5.2. Ultimate Parent Entity Subject to Taxable Dividend Deduction Regime

UPEs subject to this regime may reduce their CEBI by the number of distributable dividends, provided they meet certain conditions.

- Condition: The recipient of the dividend income must be expected to be subject to tax on the dividend income at least at the minimum corporate tax rate within the twelve months following the month in which the accounting period ends.

- Loss: Constituent entity-based losses recorded in these entities are not attributed to their owners and are considered when determining jurisdiction-based income.

6. Declaration and Payment Obligations

6.1. Local MTUT Declaration

- Deadline: The calculated Local MTUT is declared and paid from the first day to the last day of the twelfth month following the month in which the accounting period closes (1-31 December for those using the calendar year).

- Responsibility: The MNE Group may authorize one of its constituent entities in Turkey to declare and pay the entire Local MTUT on its behalf. If the tax is not paid by the authorized taxpayer, other taxpayers affiliated with the same group are jointly and severally liable.

6.2. Global MTUT Declaration

- Deadline (General): The calculated Global MTUT is declared and paid until the last day of the fifteenth month following the month in which the accounting period closes.

- Transitional Period Deadline (2024): For taxpayers filing for the first time (for the 2024 accounting period), the declaration and payment deadline is until the last day of the eighteenth month following the month in which the accounting period closes.

- Information Return Obligation: The filing of the Global MTUT Information Return is mandatory as an annex to the Global MTUT declaration.

- Exemption via Information Exchange: If the ultimate parent entity or the designated constituent entity files the Global MTUT Information Return in another jurisdiction where a qualified competent authority agreement is applied, and this is notified in the annex to the declaration, the obligation of taxpayers in Turkey to file this return ceases.

Recommendations for taxpayers regarding Local and Global Minimum Top-Up Corporate Tax (MTUT) liabilities are provided, to be appended to your previous detailed tax bulletin.

7. Our Recommendations and Actions Required

Given the complexity of the Local and Global MTUT legislation and the new administrative obligations it introduces, it is critically important for multinational enterprise groups (MNE Groups) to take the following steps to successfully manage their compliance processes:

7.1. Tax Modelling Studies

- Perform Tax Burden Simulations: Accurately calculate the jurisdiction-based tax burden for each country where the multinational enterprise group operates and regularly monitor whether this burden remains below the 15% minimum corporate tax rate. This helps in identifying low-taxed jurisdictions in advance.

- Optimize SBIE Income Exclusion: Conduct detailed calculations for the Substance-Based Income Exclusion (SBIE), which is an important mechanism for reducing the Global MTUT tax base. Plan the elements of SBIE, particularly the gross payroll expenses of employees and the net book values of tangible assets, considering the relevant transitional period rates.

- Pay Attention to Calculation in Special Transactions: If special circumstances exist, such as the international shipping income exclusion or business restructurings (mergers, acquisitions, spin-offs), meticulously analyse the impact of these transactions on the constituent entity-based income and adjusted covered taxes.

7.2. Compliance and Reporting Obligations

- Adhere to Declaration Deadlines: Remember that the Local MTUT declaration must be filed and paid by the end of the twelfth month following the accounting period (1-31 December for the calendar year); and the Global MTUT declaration must be filed and paid by the last day of the fifteenth month following the accounting period. 6 / Correctly utilize the transitional period deadline for Global MTUT for the 2024 accounting period, which is extended until the last day of the eighteenth month.

- Prepare the Global MTUT Information Return: Fulfil your obligation to submit the Global MTUT Information Return, prepared in a standard format to determine the accuracy of the Global MTUT liability, through the ultimate parent entity or a designated constituent entity.

- Document Exemptions and Exclusions: If your group includes exempt entities (public/international organizations, non-profit organizations, pension funds, etc.), prepare the relevant documents considering that although these entities are included in the revenue threshold, their profits, losses, and taxes are not included in other calculations, and they have no administrative obligations.

7.3. Management of Election Rights

- Determine the Authorization Structure: If there is a Local MTUT liability in Turkey, evaluate the possibility of having the entire Local MTUT declared and paid by a single authorized constituent entity. Otherwise, remember that all taxpayers will be jointly and severally liable.

- Evaluate Five-Year Elections: Carefully analyse your election rights that will be valid for five accounting periods, such as the equity investment inclusion election, the share option election, or the realization method election. If these elections are revoked (except for certain exceptions), they cannot be made again for the subsequent four periods.

- Utilize Loss Calculation Elections: Evaluate options such as the jurisdiction-based loss election and/or the excess tax expense procedure in jurisdictions that apply a tax system based on profit distribution or where a jurisdiction-based loss arises, with the aim of reducing your future tax burden.

7.4. Financial and Accounting Compliance

- Monitor Temporary Differences: During the transitional period, deferred tax assets and liabilities recorded in periods preceding the period subject to MTUT will be considered in MTUT calculations. Since these assets must be recalculated based on the minimum corporate tax rate, analyse historical data according to current rates.

- Track Unpaid Taxes: Manage the risk that tax expenses included in adjusted covered taxes and exceeding the Turkish Lira equivalent of 1 million Euros are not paid by the end of the third accounting period following the period in which they were calculated. If they are not paid, the tax burden for the relevant period will be recalculated.

- Apply Asymmetric FX Adjustments: Remember that asymmetric foreign exchange gains or losses arising from the difference between the currency used by the constituent entity in its accounting calculations and the currency used in local tax calculations must be adjusted.

These recommendations will help MNE Groups adopt a proactive approach to comply with the new legislation and minimize potential tax risks. We do not expect significant changes in the draft communiqué, but it is possible that new sections or additional explanations may be added to the communiqué based on feedback from different sectors. Therefore, we strongly recommend that MNE Groups closely monitor developments.

You can access the draft communiqué and its annexes published by the Revenue Administration’s website.

It is open for public consultation until October 27th, 2025.

For your questions regarding the Draft Communiqué on Local and Global Minimum Top-Up Corporate Tax and the issues covered in our bulletin, please contact us.

You can find more about the international tax issues in Türkiye by following our tax newsletters in our website. https://taxia.com.tr/insights

Best regards,

Taxademy

PDF İndir